#24: African Tech Roundup—On Starlink's Regulatory Battles & The Growth of Mobile Gaming in Africa.

👋🏾 Hello, my people!

As always, I'd like to begin by welcoming the hundreds of people who have joined #vizifam since our previous issue. I am so glad to have each and every one of you on board! Please consider this my welcome 🫶🏾

I decided to try something new in this issue, and I'd love to know what you think. In this issue, I'll focus on four notable topics, and will wrap up as I always do with interesting opportunities and content.

We have a lot to discuss in today's issue, so let's get started.

We're running a 2 minute survey to learn about how you interact with African tech content. We'd love to hear your thoughts. If you're interested, you'll also be entered into a raffle to win a $10 gift card. You can fill out the survey here:

What’s happening in Africa?

The growth of smartphone gaming in Africa

It's not surprising that, as phones have become more powerful, mobile gaming has grown in popularity worldwide. There has been a lot of academic speculation that smartphones will eventually replace PCs; some of this speculation dates back to 2010. And even at the time, data showed that there were more smartphones connected to the internet than computers, a trend that has only increased over time.

It’s not hard to see why: smartphones are more powerful, portable, and easier to manage. As smartphone adoption increased and smartphones became more powerful, the number of mobile gamers worldwide almost doubled, from 1 billion in 2017 to nearly 2 billion in 2023. Global mobile gaming revenue also doubled during the same period, rising from $46 billion to $90 billion.

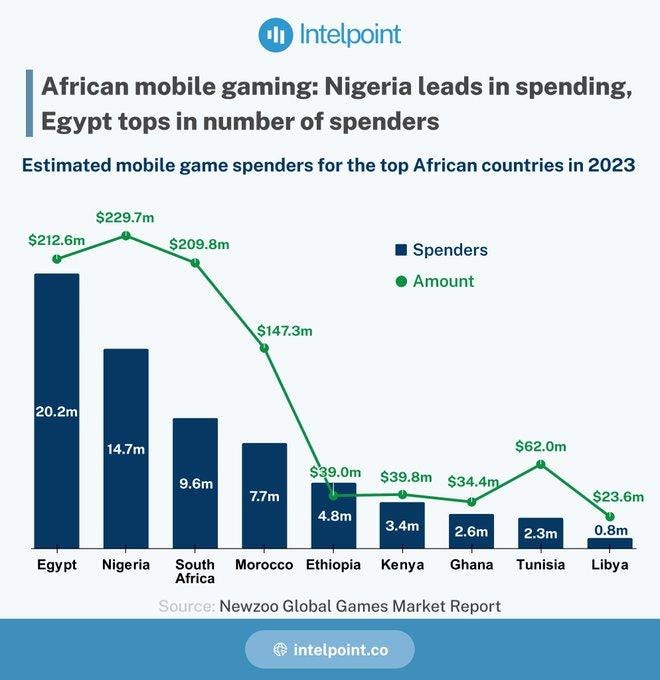

Looking deeper, the data shows that Africa has over 200 million gamers, with mobile gamers accounting for roughly 90% of the total. What's more interesting is that nearly 40% of these mobile gamers spend money on these games. Intelpoint's visuals summarize it perfectly.

Note: When I say mobile gaming, this does not include betting platforms.

According to the data, 20 million Egyptian mobile gamers, 15 million Nigerian mobile gamers, and 10 million South African mobile gamers spent more than $600 million on gaming in 2023. It is unsurprising that Africa's yearly gaming revenue is growing and nearing $1 billion.

Furthermore, data from Games Industry Africa and App Magic's research revealed the top ten mobile games in four African countries, as well as the total number of downloads and money spent on those games in 2022. I found the results to be very interesting.

In 2022, South Africans spent approximately $31 million on 10 mobile games, with Candy Crush ranking as their top revenue generator.

Nigerians, on the other hand, had Call of Duty as their number one game by revenue and spent approximately $3 million on 10 mobile games in 2022.

Egyptians spent around $11 million on ten games, while Algerians spent about $470,000. Personally, I found this interesting because I had assumed much lower numbers and that Africans rarely spent money on mobile games, which was completely incorrect. I did notice some discrepancies between the two data sets, but the central idea still remains: the gaming market in Africa is expanding, and people are spending money on games. My only question is why no African-developed game made the top ten revenue list.

On the shared lists, I noticed that one or two games in the top free ranking were local, but none of them made it to the top grossing ranking. There could be several reasons for this. The obvious one I see is that local game developers may charge in their local currency and base their pricing decisions on the average purchasing power in their countries, which reduces their revenue, particularly when converted to dollars. Whatever the reason, I'm hoping that within the next 5–10 years, we'll have at least one local game at the top of the list.

Among other things, one significant benefit of the gaming industry's growth is the ability for gaming content creators to earn money while doing what they enjoy. I know someone in Nigeria who makes money by creating content and teaching others how to play Call of Duty. Content creation is a growing income source around the world, and gaming is just one more vertical where people can be compensated for their content.

Overall, the African gaming industry is expanding, and it’s beautiful to see. And the consumer side of the industry is growing in tandem with the supply side. African game studios like South Africa’s Carry1st, Ethiopia’s Enechawet, and Nigeria’s Maliyo are creating exceptional games and promoting the African gaming industry globally.

I'm very excited about the gaming industry's future in Africa and hope to learn and write more about it. If you want to learn more about African games and the gaming industry, I recommend visiting Games Industry Africa. They're truly doing the Lord's work.

On Internet Adoption & Starlink’s Regulatory Batttles:

This is your monthly update on internet penetration in Africa. I understand that writing about it every month may seem redundant, but there are many reasons why you should care. In the years preceding COVID, remote work wasn't so popular, but the pandemic made it the norm. For the first time, businesses realized that they could hire talented people anywhere in the world as long as they had internet access!

So, with COVID, we saw an increase in remote work from the West coming into Africa, which is essentially the export of services. Because the people who worked for these foreign companies lived and spent the majority of their money in their home countries, it benefited the local economy.

Additionally, think about the gig and creator economies. These internet-powered spaces have given Africans more opportunities to make money and enhance their quality of life. Think about the impact African food delivery platforms like Chowdeck, mobility platforms like Uber, and agency banking platforms like Moniepoint and MTN MoMo have had on people's lives.

We can also consider the ease with which we can now obtain information. Social media, in particular, has helped to level the playing field in some ways and made foreign countries feel closer. We now have greater access to knowledge and productivity tools than ever before. We are more exposed, and we can use the internet to improve our skills, which is more than we could say 20 years ago. I don’t want to overstate the point, but you get the gist.

So, if Africa is expected to house approximately 42% of the world's youth by 2030, which is only 6 years away, we must quickly equip ourselves with the tools to leverage this young population for the continent's success, and I believe the internet, among other things, plays a crucial role in this strategy.

Interestingly, Isabel Neto, the World Bank's Digital Development Practice Manager for Africa, stated at a conference two weeks ago that the continent requires $86 billion to become fully connected to the internet. Among other things, she stated that while we have approximately 55% of the continent connected to the internet [I disagree; the statistics suggest it's less than 45%], we need to reach near 100%, and we need to address the continent's slow internet speed.

For context, Africa has a population of 1.4 billion people, which is about equal to the populations of China and India. China and India have internet penetration rates of 70% and 60%, respectively, whereas Africa's internet penetration rate remains at 43%, lower than the global average of 66%. This means that Africa has the lowest internet penetration rate in the world when compared to other continents. 798 million Africans do not yet have access to the Internet. So you can understand why this is a serious issue.

What's more, the internet brought with it social media, which has amplified the voices of Africans and, in turn, made the government feel threatened. Africans are now able to hold their governments more accountable and show the world the injustices that have plagued their countries, which has made the government very uncomfortable. This has resulted in several internet censorships and shutdowns in African countries, particularly around elections.

In the last five years, 23 of Africa's 54 countries have faced at least one internet censorship or shutdown. Algeria, Benin, Burkina Faso, Burundi, Chad, Congo, Egypt, Eritrea, Eswatini, Ethiopia, Gabon, Guinea, Liberia, Mali, Mauritania, Niger, Nigeria, Senegal, Sierra Leone, Sudan, Tanzania, Togo, Uganda, Zambia, and Zimbabwe have all been affected by the endemic. In fact, at least 19 internet shutdowns occurred in Burkina Faso, Congo, Ethiopia, Gabon, Nigeria, Senegal, Sudan, Uganda, and Zambia in 2021.

Regardless, it appears that some countries are starting to do better. These countries are now realizing how important access to the internet is to the growth and success of their economies. This is why I keep track of internet growth in different countries and choose to share my findings with you. Before I begin, please keep in mind that this update is heavily focused on Starlink's regulatory battles in Africa because that is where most of the latest action is.

Following a battle against illegal Starlink users, Ghana's Communications Authority has approved Starlink as a satellite internet provider. This is not surprising given what happened last month with the West African internet outage, which led them to advocate for satellite internet. It is important to note that, while Starlink has been approved, their license has not yet been released, so using Starlink in Ghana is still technically illegal.

Regardless, Ghana will join Benin, Kenya, Malawi, Mauritius, Mozambique, Nigeria, Rwanda, Sierra Leone, and Zambia as countries where Starlink use is legal. Starlink is still illegal to use in Burkina Faso, Botswana, the Congo, Côte d'Ivoire, Mali, Senegal, South Africa, and Zimbabwe. Furthermore, Starlink seems to be cracking down on the use of their product in unauthorized locations.

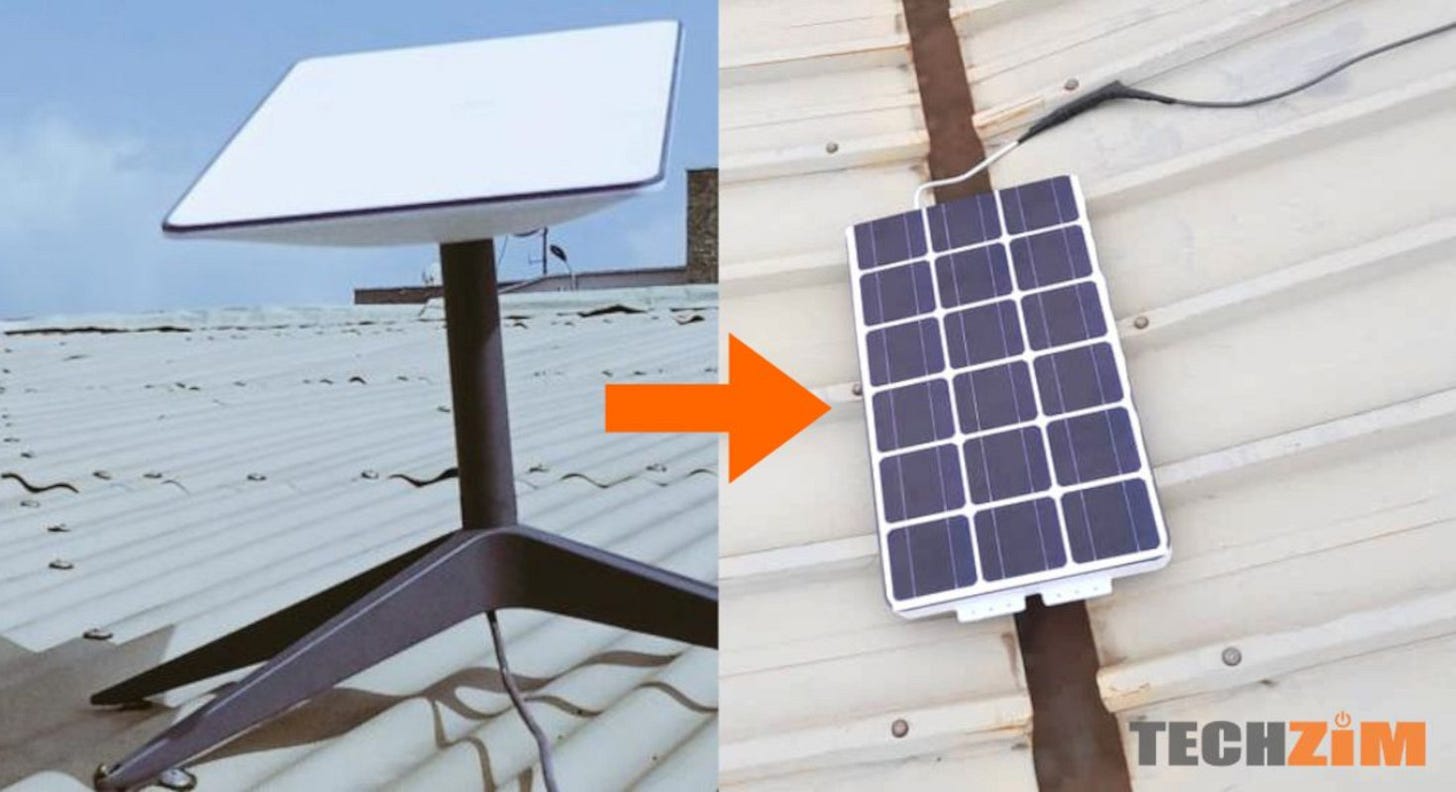

Previously, users in unauthorized areas were able to use their product by importing their kits from countries where they were approved and using Starlink's roaming plans, which were originally designed for temporary use by customers who were travelling. Starlink recently announced that they would be turning off their internet in countries like South Africa and Botswana where the product is illegal, as they did in Congo and Zimbabwe.

Zimbabwe, in particular, has had an intense battle with Starlink users. Zimbabweans want Starlink because it is less expensive than their current internet service providers and has better connections, but the government has been actively opposing its use in the country. Their reason is that Starlink does not have the necessary license to operate in the country. The government has gone so far as to arrest people for using Starlink in the country, which I think is very extreme. This led Zimbabweans to find creative ways to hide their Starlink kits.

Zimbabwean Starlink users believe that the government's fierce opposition to Starlink is motivated by a desire for tyranny, with which I agree. The current Zimbabwean Communications Agency laws would require Starlink to pay fees and taxes to operate in the country, which is standard practice, but they would also require Starlink to give the government the authority to turn off the internet at any time. Except for Starlink, all internet service providers in Zimbabwe have already agreed to these laws.

Zimbabweans see this law as the government's attempt to keep them suppressed and violate their right to free opinion and expression, which is a valid concern. Interestingly, we learnt last week that Starlink has finally applied for a license to operate in Zimbabwe. Everyone is now waiting for the results of the application, which could take several months. Since May 2023, Motswanans [people from Botswana] have been awaiting the outcome of the Starlink license application. However, Zimbabweans remain optimistic and are hoping for a favourable outcome because it is clear that while this decision appears to be commercial, it is actually a political one.

Q1 2024 African funding summary:

This visual summary from Africa: The Big Deal publication basically tells you everything you need to know about startup funding in Africa in Q1 2024. It was interesting to see that the mobility tech sector received the most funding of all the sectors. But it's important to note that Moove is a mobility tech startup that raised 110 million, accounting for 72% of the $151 million raised by mobility tech startups. Interestingly, when we look at the sector ranking based on the number of deals, you'll see fintech startups had the most deals and activity.

What's even more intriguing about this Moove raise is that, according to a podcast I listened to, an investor who was involved in the deal implied that it was not recent; rather, it was only recently announced. Now, this is not an uncommon practice. Startups sometimes announce deals months or even years after they have occurred. So if we exclude Moove's deal, we can speculate that African startups raised $356 million in the first quarter of 2024, a record low not seen since 2020.

Looking closer, we can see that Q1 2022 was still the quarter in which African startups raised the most money and had the highest number of deals worth at least $1 million. Unfortunately, Q1 2024 saw one of the lowest totals raised by African startups. The good news is that the number of $1 million transactions is increasing, so there is an upside to all of this. Based on what happened in 2023, we were certainly hoping for a better start in 2024. There have been a good number of investment fund raises, and we know it takes time for deals to happen and be announced, so we remain optimistic as we await Q2 2024.

Notable fund raises across Africa:

As I earlier stated, 2024 has seen the announcement of sizable investment funds. From Partech Africa’s fund to Norrsken to the UNDP’s Timbuktoo Initiative, we’re seeing an influx of capital into African funds that would go ahead to invest in African startups.

TLcom Capital announced a $165 million oversubscribed fund, which was very exciting for me, especially since Partech's fund was also oversubscribed. To me, that's a good sign and a testament to their track record, as well as a desire for people to invest in the African startup ecosystem.

Verod-Kepple Africa Ventures also announced a $60 million fund that will invest in Series A and B startups. According to their press release, they will invest in companies that are developing digital infrastructure in a variety of sectors; inefficiency solvers who are resolving friction between businesses or between businesses and consumers; and market creators who are creating economic opportunities for people based on the changing dynamics of the African economy and demographics.

Adenia Partners, a private equity firm, also announced its $470 million Africa-focused fund, which was also oversubscribed.

Sim Shagaya, founder of ULesson and Konga, has launched the Honey Badger Fund to help African entrepreneurs build globally impactful technology companies. Sim stated that he would invest with his personal funds, but I believe it is a remarkable initiative that deserves to be noted.

Opportunities: Grants, Fellowships & Accelerators.

Africa Business Heroes supports African entrepreneurs, aiming to build a sustainable and inclusive future. Applications are open to all sectors, ages, and ages. Ten finalists compete in a grand finale pitch competition to win a share of US $1.5 million in grant money.

Deadline: June 9, 2024.The Social Shifters Global Innovation Challenge is looking for young entrepreneurs and leaders between the ages of 18 and 30 who have innovative ideas to address pressing environmental and social issues. There are multiple grant funding awards of up to $10,000 USD available to assist you in launching or scaling.

Deadline: July 31, 2024.The Ban Ki-moon Centre for Global Citizens (BKMC) is hosting a workshop series on climate adaptation in agriculture. The initiative brings together 15 young farmers and agricultural entrepreneurs from Ghana, Kenya, Nigeria, Rwanda, and Zambia to share their experiences and develop a youth demand paper.

Deadline: May 20, 2024.The Creativity Pioneers Fund supports cultural and creative organizations promoting social change by providing unrestricted funding of 5,000 euros.

Deadline: May 27, 2024.The Awaji Youth Federation (AYF) Fellowship Program 2024 is a 9-month live-in working program on Awaji Island, Japan, focusing on PR & Marketing, Art & Music, Health & Wellness, and Design & Technology. The program aims to turn 'imagination into action' and provide a unique global perspective to the localized community. Benefits include a monthly salary of JPY 197,000, accommodation and utilities, 10 days of paid leave, and visa support.

Deadline: May 31, 2024.

On an unrelated note:

Here are five of my favourite reads and listens this week:

Why Wall Street Is Dumping Streaming Companies Despite Record Viewers

How 23andMe Went From $6B Valuation to Penny Stock | WSJ What Went Wrong

Iyinoluwa Aboyeji Reveals What it Takes to Build a Successful Tech Company from Nigeria

Kings of Enterprise: Believers in the Boardroom by Mrs. Ibukun Awosika

Signing Out:

Alright, folks! We’ve come to the end of this issue. I hope you found it insightful. I’d also love to know what you think about this new format, so please share your thoughts in the comments section!

Also, don’t hesitate to reach out if you have any questions, or if you just want to connect — I'm always here at dumss@vizible.africa.

I’m wishing you the best month ahead! 💫

Yours in Product Discovery,

Dumss ✨

WOW SO INSIGHTFUL! THANKS DAMI