Catching up with African Tech: Week of August 5th

This week: Nuru spotlighted for renewable energy in DRC. Jumia reports $20M Q2 loss amid currency challenges. Kuda triples revenue to $22M despite net losses. AliExpress enters the Ethiopia.

👋🏾 Hello people!

Welcome to this week’s digest. As always, we have much to cover so let’s get to it.

Product Launches:

SwipeFlex: Nigerian fintech Swipe partners with Renmoney to launch digital lending platform offering instant, affordable loans to improve financial inclusion.

Network One: Dubai's Network International launches digital payment platform in Nigeria, enhancing local processing and aiming for 95% financial inclusion.

Glovo ads: Quick commerce startup Glovo introduces advertising services for businesses on its platform in Nigeria, diversifying revenue streams. This move follows reports of a similar service being developed by rival Chowdeck. This could become a standard business model for other food and grocery delivery startups in Nigeria.

This week in fundraising:

Product Spotlight: Nuru

Who they are: Nuru is a Congolese renewable energy company dedicated to providing reliable and affordable energy solutions in the Democratic Republic of Congo (DRC). They focus on transforming lives and communities by powering essential services and infrastructure through innovative energy solutions.

The problem they're solving: The DRC faces significant challenges in accessing reliable electricity, with a large portion of the population living without power. This energy scarcity hampers economic development, healthcare, education, and overall quality of life. Nuru aims to bridge this gap by delivering sustainable energy to underserved regions, addressing the critical need for reliable power.

How they're solving it: Nuru employs a combination of solar hybrid mini-grids and cutting-edge technology to provide off-grid energy solutions. Their approach allows for the generation and distribution of clean, renewable energy in remote and rural areas where traditional grid access is either unavailable or unreliable. By doing so, Nuru not only improves living standards but also fosters economic growth by powering businesses, schools, health centres, and homes. Their model is designed to be scalable and replicable across various regions in the DRC and beyond.

You can learn more about Nuru here.

What’s happening in the ecosystem:

Jumia faces financial challenges amid market pressures:

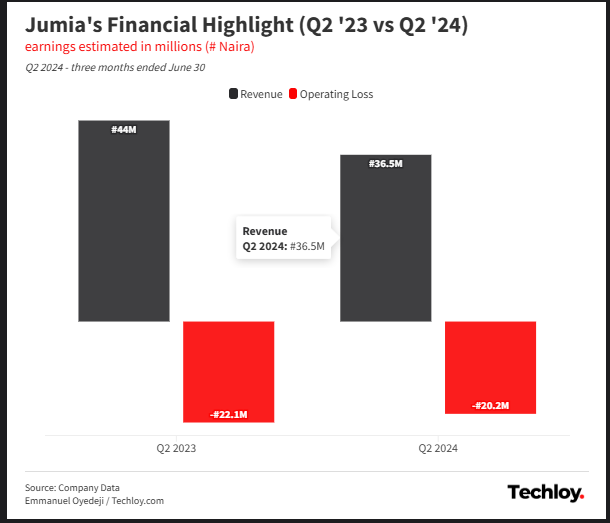

Jumia, a leading African e-commerce platform, reported a $20 million loss for Q2 2024, significantly impacted by currency devaluations in major markets like Nigeria and Egypt. Revenue fell 17% year-over-year to $36.5 million, and gross merchandise value (GMV) dropped 5% to $170.1 million. However, in constant currency terms, there was a 15% revenue increase and a 35% GMV rise, showcasing underlying operational resilience despite macroeconomic challenges.

The company has implemented cost-cutting measures, including laying off 900 employees, which helped reduce operating losses by 8% compared to the previous year. Jumia is also refining its business model by reducing incentive-driven orders, which fell from 31% to 28%. A positive highlight was the growth of JumiaPay, its fintech arm, which saw a 30.8% increase in transactions to 1.9 million, driven by successful campaigns and expanded service penetration.

Looking ahead, Jumia remains optimistic about its path to profitability, despite facing inflationary pressures and regulatory hurdles. The company plans to increase orders and GMV throughout the year, balancing strategic growth with ongoing cost management. Navigating these external pressures will be critical for Jumia as it seeks to transform financial fluctuations into a steady progression toward profitability.

Kuda's revenue grows with recent expansion despite challenges:

Kuda, a neobank focused on Nigeria, tripled its revenue to $22 million in 2022, significantly boosting its user base from 2.4 million to 4.9 million. The digital banking platform, backed by Target Global, operates primarily in Nigeria and offers a range of financial services, including payments and loans. The company has been expanding its product offerings, such as international remittances, and is exploring new markets like the U.K., Canada, and several African countries.

Kuda's total deposits more than doubled from $41 million in 2021 to $100 million in 2022, with business banking services seeing substantial growth. The company also increased its treasury investments, earning $3.5 million from such activities. Despite these successes, Kuda faces financial challenges, with net losses doubling to $32 million due to rising operational costs.

To address financial pressures, Kuda has reduced its marketing expenditure and focused on achieving breakeven. Despite a decline in cash reserves, the company remains confident in its ability to reach financial stability without additional fundraising. Kuda's strategic focus on sticky deposits and treasury investments positions it for continued growth amidst a challenging economic landscape.

Hohm Energy in turmoil despite recent funding:

Hohm Energy, a South African solar company, is grappling with financial distress only months after raising $8 million. The firm has entered a business rescue process to address severe cash flow problems and debt issues, resulting in layoffs. Under South African law, this process lasts for three months, during which a practitioner will assess the company's situation and liaise with creditors. Internal conflicts have arisen, with former CEO Tim Ohlsen recently resigning and new leadership taking controversial steps without shareholder agreement.

Founded in 2021, Hohm Energy aimed to capitalize on South Africa’s energy woes with a solar marketplace facilitating installations and financing. By February 2024, they had generated over 17,000 designs worth $190 million, with $90 million in financing applications. However, improvements in grid reliability have led to decreased demand, exposing the company’s structural weaknesses. Rapid expansion and poor governance, including delayed board formation, have contributed to these challenges.

Investors have noted governance and transparency issues within Hohm, which may have hindered timely intervention by its parent company, Spark Energy Services. Moving forward, Spark plans further investment post-rescue, emphasizing a new business model and management team to stabilize operations. The goal remains to achieve the best outcome for all stakeholders, despite the current adverse circumstances.

AliExpress Ventures into Ethiopia’s eCommerce Market

Last week, we shared Shein & Temu’s Africa expansion plans, and it seems like AliExpress is joining the list of Chinese companies growing their African presence.

AliExpress, a subsidiary of Alibaba Group, is set to enter the Ethiopian market, aligning with the country’s recent reforms to attract foreign investment. This move follows a partnership with Ethiopia to develop an Electronic World Trade Platform (eWTP), designed to enhance trade and support small and medium-sized enterprises (SMEs). AliExpress' entry is expected to create jobs, drive innovation, and showcase local products globally.

The Ethiopian government has implemented reforms, including a new licensing regime for electronic platforms, to foster a more enabling environment for digital commerce. As part of these efforts, the Ethiopian Investment Board introduced a directive to regulate foreign participation in trade, previously reserved for domestic investors. These changes are aimed at boosting the digital economy and streamlining e-commerce business registration.

Seven South African startups win Irish Tech Challenge:

Seven South African tech startups each secured €10,000 from the Irish Tech Challenge, a collaboration involving the Embassy of Ireland and Wits University. The selected startups will undergo a pre-acceleration program in South Africa, culminating in a showcase at the Tshimologong Digital Innovation Precinct.

The selected innovators are:

Smartview Technology: Providing enterprise-grade utility management solutions for businesses to control costs, improve efficiency, and reduce environmental impact.

Momint: Utilizing blockchain technology to facilitate investment in renewable energy projects, enabling individuals to co-invest and contribute to a sustainable transition.

The Awareness Company: Using data to help organizations achieve operational efficiency and sustainability through their software product, Hydra.

Athena: Enabling affordable access to healthcare services by allowing patients to pay for medical treatment costs in monthly installments.

AdBot: Providing online advertising solutions for small business owners, making online advertising easy, effective, and accessible.

Samanjalo: Transforming coal waste (fly ash) into green products for construction and infrastructure using geo-polymer technology.

Credipple: Creating a talent marketplace for trusted creative and digital professionals, streamlining the hiring process for remote work professionals.

Opportunities: Fellowships, Programs & Accelerators.

The Baobab Network Accelerator, a three-month program for early-stage African tech startups, provides $100,000 in funding, tailored support, and access to a global network of experts and mentors in exchange for 12.5% equity. Applications for the next accelerator cohort are open.

The Accelerate Africa program provides early-stage African startups with access to a wide network of investors and experts. While no funding or equity is offered upfront, startups may receive $250,000 - $500,000 post-program. Applications for the new cohort are now open.

Her Startup Program for African Female Entrepreneurs is offering up to $5,000 in funding and 14 weeks of intensive training and mentoring to support African women-led early-stage companies with high growth potential in emerging industries. Applications close September 13, 2024.

The Orange Corners Ghana Accelerator Cohort 10, a collaborative initiative of the Kingdom of the Netherlands and GrowthAfrica, is accepting applications for its six-month acceleration program designed to support ambitious young Ghanaian entrepreneurs and nurture Ghana's entrepreneurship ecosystem. Applications close September 1st, 2024.

The SAIS Investment Readiness Program is offering a year-long program for African tech start-ups in agriculture, livestock, food, and climate, providing up to 35,000 EUR in support, including mentorship, training, and investment facilitation. Applications close September 2nd.

FCMB is hosting a six-month Agritech Hackathon and Venture Building Program designed to support early-stage businesses across Africa. The program, which includes a 3-month hackathon and 6-week venture building sprints, offers up to N23 Million in funding, mentorship, and access to market through corporate partnerships. Applications close September 5, 2024.

On an unrelated note:

Here are some of my favourite reads of the week:

Signing Out:

Alright, folks! We’ve come to the end of this issue.

As we wrap up, if you feel like we missed any big news or insights this week, please let us know what they are in the comments. I’m sure the community would benefit a lot from it!

I’m wishing you the best week yet.

See you next week ✌🏾