Week of July 22nd Digest: On Mercury, Copia & Others.

This week: Mercury closes accounts for startups in 13 African countries. $1B raised by African startups by July. Ticketmaster acquires Quicket. Risevest eyes Kenya.

👋🏾 Hello people!

I hope your week is off to a great start!

Welcome to the latest edition of our weekly African tech digest.

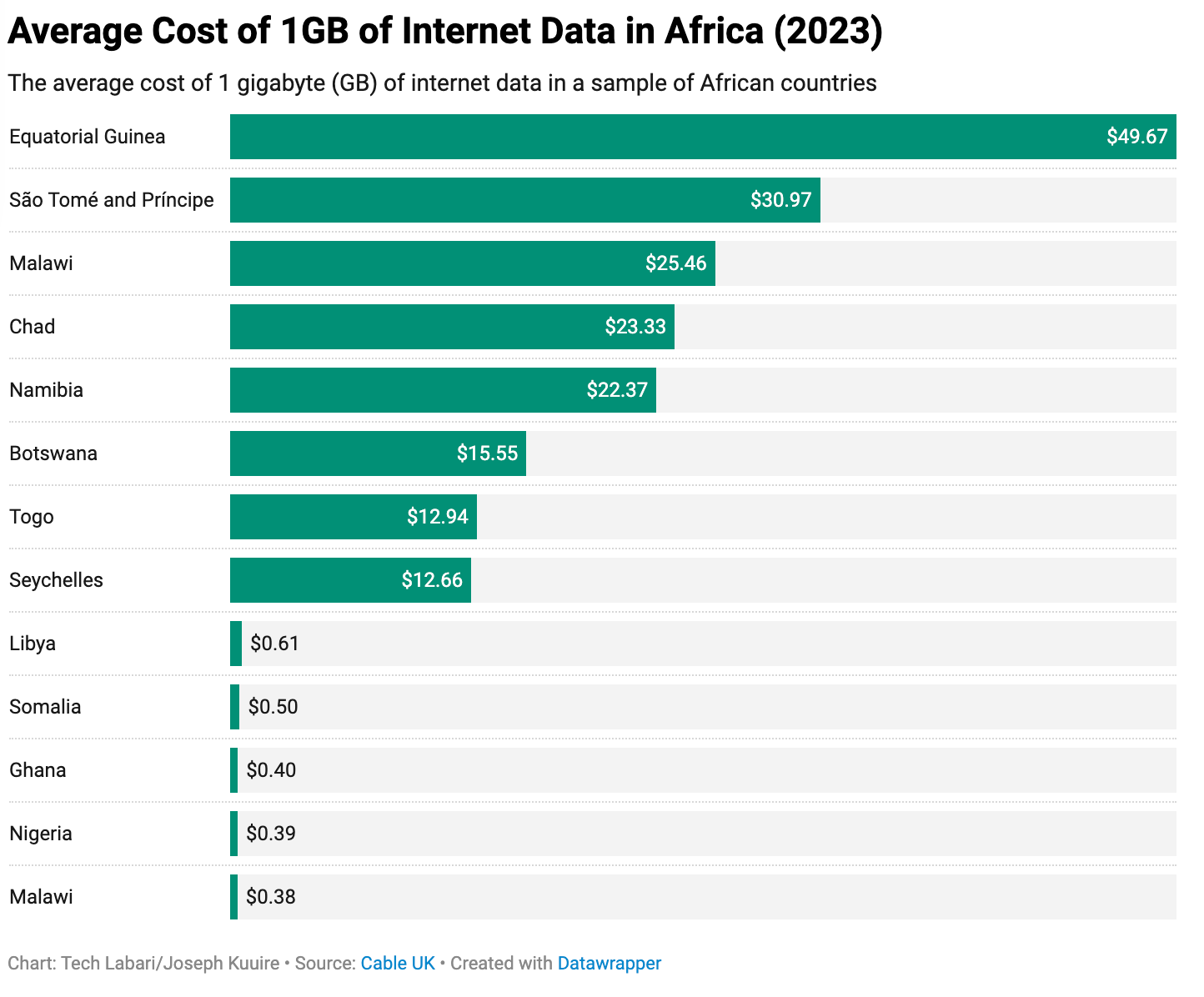

Earlier this week, I saw a visualization that piqued my interest.

I had always assumed that Nigeria had one of the highest data costs in the continent, so imagine my surprise when I saw this graph.

It had me asking a lot of questions around the relationship between data costs and the development of a country’s startup ecosystem.

I also found it interesting that the internet penetration rate of 5 out of the 7 countries ranged from 19% to 53%, which is grossly below the worldwide average of 66%.

This was not a surprising insight because costs would obviously make the internet inaccessible. I thought to cross reference the costs against the country’s minimum wage and also against income per capita, but I didn’t want to derail the newsletter too much lol.

My key takeaway from this visualization is that we need to make internet on the continent more affordable and accessible.

Enough of my rambling. As always, we have a lot to cover today, so let's get to it.

This week in fundraising:

Latest Product Launches:

Afriex, a cross-border payments fintech, has launched Global Accounts that offers USD, GBP, and EUR accounts. Users can receive, send, and manage multiple currencies via mobile app.

AgroEknor, a hibiscus exporter, has launched YieldPro, an operating system that allows farmers to sustainably increase yields and trace agricultural processes.

Ethiopian Wegagen Bank has launched Efoyta, a digital loan app that allows MSMEs and salaried employees to access instant loans.

Product Spotlight: M-KOPA

Who they are: M-KOPA is a Kenyan-based fintech company that provides pay-as-you-go financing for essential products, such as solar lighting, smartphones, and home appliances.

The problem they're solving: Many households in Africa lack access to affordable financing options for essential products. This lack of access can hinder economic development, education, and quality of life. M-KOPA works to enable over a million households in East Africa to access affordable and reliable energy and technology, significantly improving their quality of life.

How they're solving it: M-KOPA uses a pay-as-you-go model, allowing customers to make small, manageable payments over time via mobile money. This model makes essential products more accessible and affordable. Customers can purchase solar lighting systems, smartphones, and other appliances with an initial deposit and then pay off the balance in daily or weekly instalments. Once the product is fully paid off, it becomes the customer's property.

You can learn more about M-KOPA & their impact here

What’s happening in the ecosystem:

US Digital Bank, Mercury, To Close the Accounts of Some African Startups:

Last week, African Mercury users faced an upheaval. Mercury, a digital bank, announced it will close the accounts of startups in 13 African countries by August 22, 2024. This move, driven by internal compliance changes, affects startups incorporated in Delaware unless their founders reside in the U.S.

The affected countries are on the Financial Action Task Force (FATF) Greylist due to money laundering and terrorism financing regulation deficiencies. These restrictions come in response to regulatory crackdowns on U.S. commercial banks.

Mercury has previously restricted transfers and accounts of tech startups due to compliance concerns. Nigerian tech startups, which often keep capital in U.S. dollars for operational ease, will need to seek alternatives like Brex, Ramp, Wise, or fintechs such as Leatherback, Raenest, and Graph.

Mercury’s founder explained the decision on Hacker News:

Though the decision wasn’t malicious, it’s a tough blow for affected startups. It was particularly frustrating for founders from these countries living in the U.S. or Canada who also received account closure notices.

This has sparked discussions on the role of African countries in the global economy, the risks of serving these markets, and the high cost of fraud. For more insight, check out this clip: Watch Here.

The 13 affected countries are Burundi, Cameroon, Central African Republic, DR Congo, Congo, Liberia, Mali, Mozambique, Nigeria, Somalia, South Sudan, Sudan, and Zimbabwe.

Start-up investments in Africa in 2024 have now crossed the $1 billion mark:

July 2024 has been a game-changer for African startups, with funding crossing the $1 billion mark.

Two mega deals - d.light's $176 million facility and MNT-Halan's $157.5m raise - along with NALA's $40m Series A, have made this the most successful month in over a year.

While investment pace isn't matching 2021-2023 levels, it's outperforming 2019-2020 benchmarks. 2024 funding has already surpassed 2020's total.

Copia Global’s Co-Founder Tracey Turner is Starting a New Venture:

Tracey Turner, co-founder of Copia Global, is launching a new company after Copia's recent administration. The new venture, registered in Kenya, will focus on delivering household items in Nairobi and nearby suburbs. Turner is negotiating with investors, with three already committed. Former Copia CEO Tim Steel will join the new team.

This development has raised eyebrows, given Copia’s administration in May 2024. The company, which raised $123 million across eight funding rounds, had been struggling and laid off around 1,060 staff. The news of Copia’s administration was met with confusion and disappointment.

Turner and Steel haven’t commented yet, but the new venture is expected to start operations by September or October.

Ticketmaster has acquired South African Ticketing Marketplace, Quicket.

Ticketmaster's acquisition of Quicket is a game-changer for Africa's live events scene. The deal combines Ticketmaster's global reach with Quicket's local expertise in South Africa, Nigeria, Uganda, Kenya, Zambia, and Botswana. Quicket will keep operating independently from Cape Town under James Tagg's leadership.

This move follows Ticketmaster's 2022 entry into South Africa, aiming to serve events of all sizes. While Quicket's revenue ($6.1M in 2024) is a small slice of South Africa's $383.8M ticketing market, Ticketmaster sees potential. The acquisition gives them access to African creators and artists, boosting their competitiveness against bigger local players.

Nigeria's Risevest looking to expand to Kenya through Hisa acquisition:

Risevest, the Nigerian fintech enabling global investments, is in talks to acquire Hisa, a Kenyan startup offering access to US stocks. This move comes just after Risevest's Chaka acquisition in 2023.

While the deal's not sealed yet, it's clear Risevest is hungry for the Kenyan market. Hisa, valued at $5 million post-money in 2022, could be Risevest's ticket to bypass the headache of new registrations and licenses in Kenya. With 600,000 users under its belt, Risevest's looking to flex its muscles in Kenya's budding fintech scene.

Opportunities:

GameUp Africa 2024 is now open for aspiring game devs, artists, audio producers, and marketers across Africa. Fully remote with new curriculum tracks and global mentorship.

The Seed Lab, by AfDB and Open Capital, is a 3-month program for Agri-SMEs in Kenya, Uganda, Nigeria, and Ghana. Apply by August 5, 2024, to gain strategic skills and access to finance.

The Cleva-AltSchool Scholarship Fund is offering free training in Data, Engineering, Product, and Creative Economy for young African tech talent. Apply to access this opportunity.

Berkeley SkyDeck’s Batch 19 Info Session is now open for founders seeking capital and global connections. Join the virtual event on July 30 for a chance at $200k, elite mentorship, and access to top investors.

The Future is Female Mentorship Program is open for early-stage African female tech founders to gain PR and communications skills, with insights from top experts and access to global networks. Deadline: July 31, 2024.

On an unrelated note:

Here are some of my favourite listens and reads of the week:

Signing Out:

Alright, folks! We’ve come to the end of this issue.

As we wrap up, if you feel like we missed any big news or insights this week, please let us know what they are in the comments. I’m sure the community would benefit a lot from it!

I’m wishing you the most fulfilling week yet.

See you next week ✌🏾